PRADACE: WHAT'S NEXT FOR VERSACE IN THE PRADA UNIVERSE

Despite its struggles, Versace has the potential for a comeback.

In a show of Italian unity the likes of which fashion rarely sees at such scale, it was announced last week that Prada Group acquired Versace for $1.38 billion, a price nearly half of what Michael Kors’ Capri Holdings paid for it in 2018. The news ended months of speculation about what might happen to Versace after Capri’s merger with Tapestry was effectively axed by the Federal Trade Commission late last year and the conglomerate started taking steps to unload most of its portfolio. But rather than a conclusion to the story, the official decree has got me thinking about what exactly comes next – and whether or not the deal even makes sense to begin with.

It should be noted that this isn’t the first time Prada Group has brought another major fashion label into its fold. It has, however, been many years since it has chosen to do so. Helmut Lang, Azzedine Alaïa and a majority stake of Jil Sander were all owned by the Italian company at one point. Prada no longer has an association with any of these brands but does still count Church’s and Car Shoe, both footwear companies, among its ranks. As for the reason Prada shifted into buying mode, there was undoubtedly more than goodwill for a compatriot that sparked interest in once again growing its roster.

Besides obtaining a brand with strong name recognition and IP at a significant discount, Prada’s need to diversify and promote new talent were likely factors. Plus, as Vogue Business mentioned, it is one of the few major luxury groups enduring the luxury downturn relatively unscathed, leaving it with the necessary cash even as behemoths LVMH and Kering struggle. Prada Group only releases select figures during earnings calls, however, it did divulge that Miu Miu enjoyed 93 percent year-over-year retail growth compared to Prada’s four percent. Miu Miu has been on a hot streak thanks to 1) Miuccia Prada’s renewed focus on the brand and 2) the fact that Raf Simons has (mercifully) not tampered with it yet. Yes, Miu Miu looks spectacular all on its own, but it looks even better when compared to the mockery that Simons is making of Prada.

Though I’m sure many would deny it, there is a general souring toward Prada happening behind the scenes – almost no industry folks will say so publicly – and the tamer, more familiar Fall 2025 collection from Miuccia and co-designer Raf Simons signals that the company is aware of its evaporated unimpeachability, course correcting before financials take a hit. Bringing in Versace offers an opportunity to buoy interest in the group as a whole while also presenting a new focal point for consumers and media that could, in theory, offset a faltering Prada. (For the record, I do not believe Simons will be at the brand for the long haul. He hasn’t stayed the course anywhere else, and I don’t think he’s going to start now. The results speak for themselves.)

Part of the acquisition deal dictated that Donatella Versace, the founder’s sister and shepherd of the brand since his murder, would step down from her current role to assume a new post as, more or less, a vaunted brand ambassador. It was time for a change, but Prada Group’s own history foreshadowed the move. Patrizio Bertelli, Miuccia’s husband and former co-CEO, has a rocky reputation when it comes to designer relations (he’s reputedly a significant reason why Jil Sander left her namesake label). Not having to tussle with a major figure like Donatella in-house was likely more appealing.

No official announcement has been made regarding who will replace Donatella and the rumor mill doesn’t yet appear to have a favorite either. Donatella was instrumental to the Versace aesthetic even before she assumed the top job, a position she ultimately held longer than her brother Gianni. During her tenure, she created a painfully glamorous vision of women with many moments that will live forever in the cultural canon. But much like Lagerfeld’s version of Chanel, one couldn’t help but get the sense she’d stayed too long at the fair. New blood with meaningful experience can go a long way to refreshing the brand, but that’s not all it’ll need to achieve success.

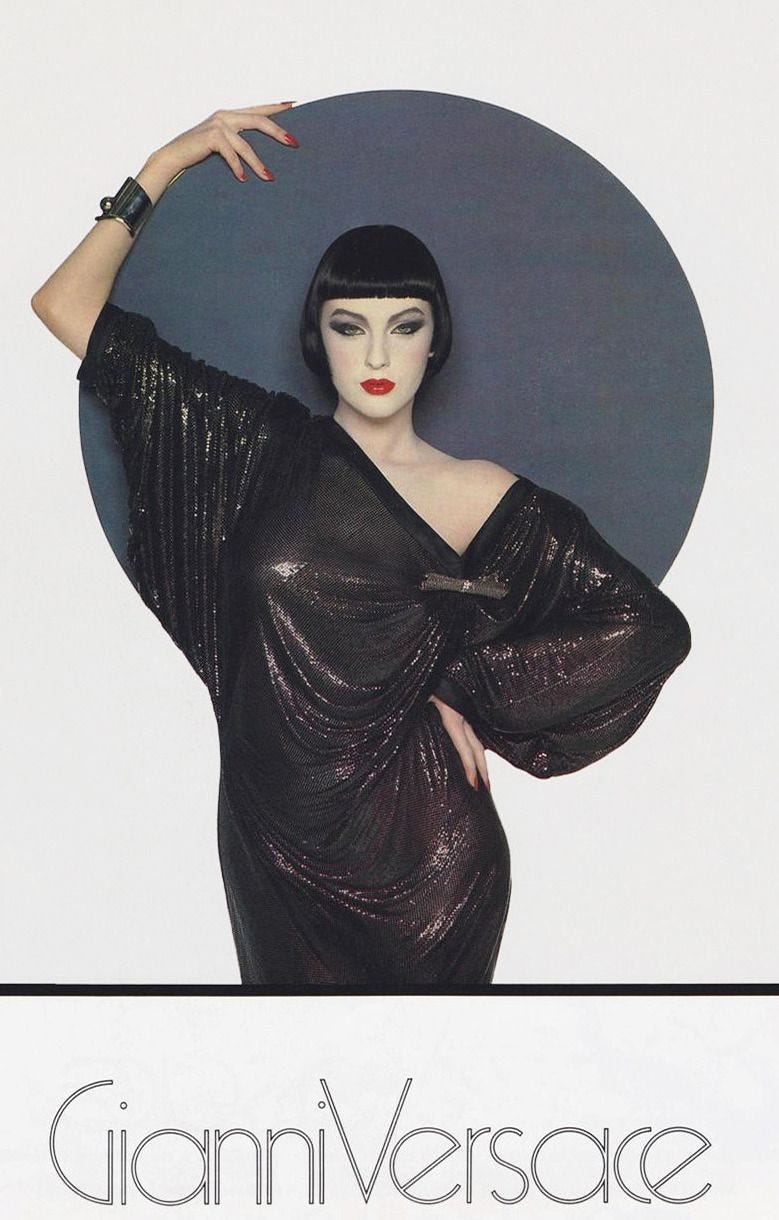

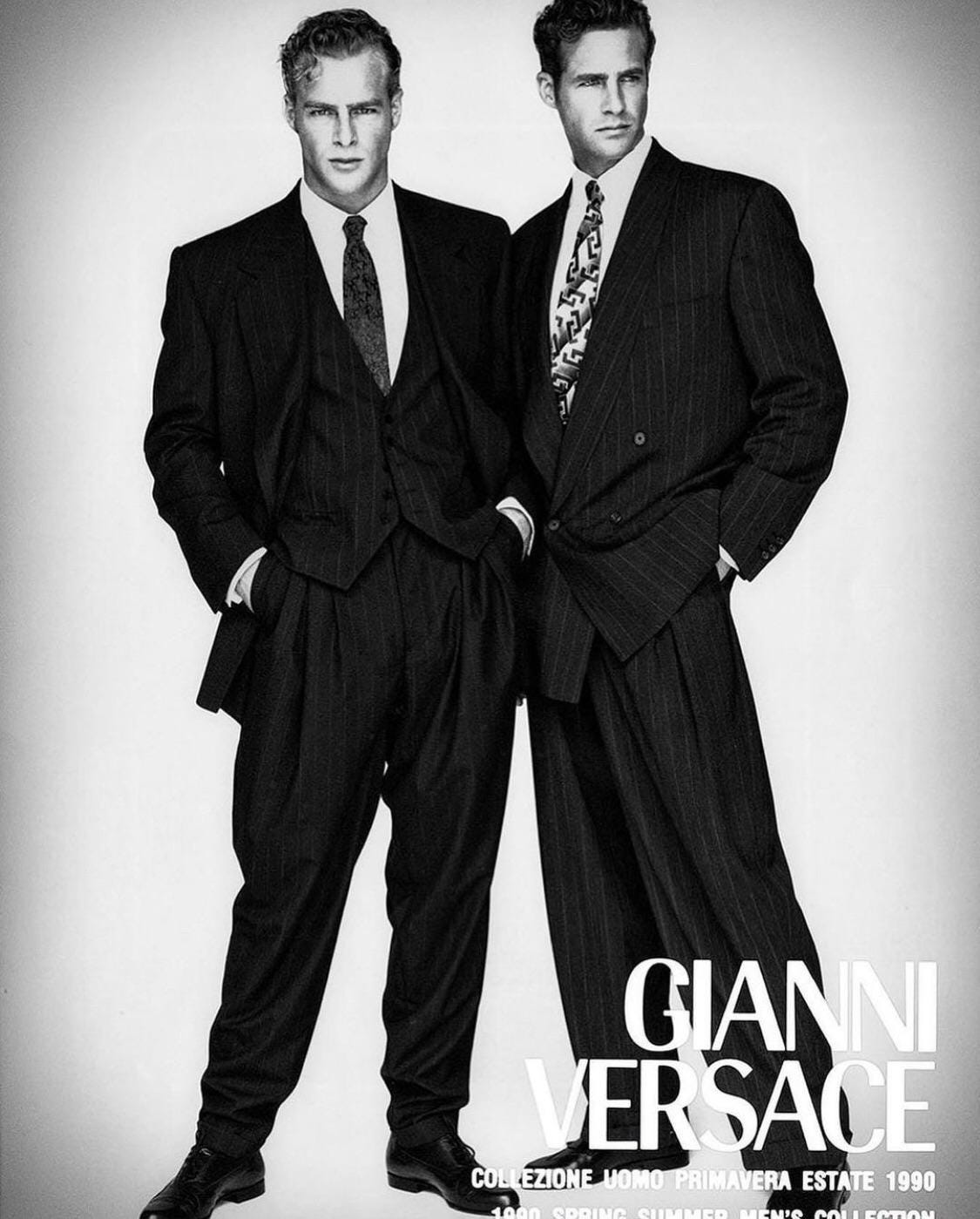

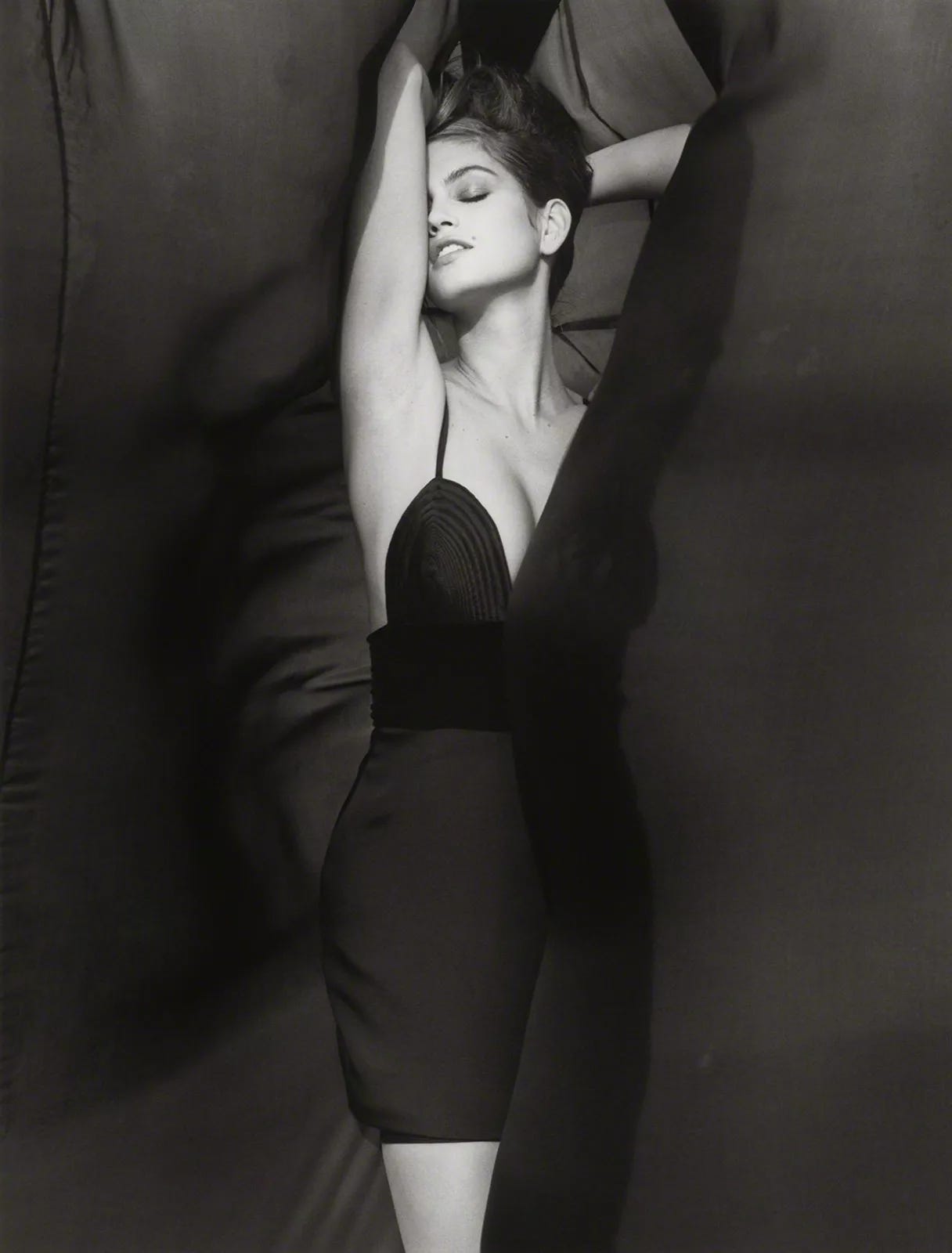

Between Oroton chainmail dresses, Baroque prints, the Greek key motif and hissing Medusa head, Versace has a wealth of identifiable signatures. For the past several years, the brand has leaned into them not in celebration but due to a dearth of real ideas. Slapping a print on a jacket or dress can’t disguise that it’s uninteresting. What once felt focused became trite. There is so much to the Versace legacy that I’ve rarely seen riffed on, like the elegant oversized tailoring or ‘30s-inspired silhouettes that run throughout Gianni’s work in the 1970s and 1980s. To expand the idea of what the public perceives Versace to be while keeping aesthetic harmony would be the greatest coup.

However, all of that is of little consequence if Versace can’t get a grasp on its quality, which has fallen precipitously over the past several years. Thin fabrics; plastic-y shoes; price tags in the thousands for pure polyester. I’ve recently gone through racks of new Versace merchandise only to question if it wasn’t meant for Zara. With designs displaying bright colors and short, figure-hugging silhouettes, anything less than excellent make can render the products’ look cheap. Production must get back on track.

Even if everything goes right, I question how long this commitment from the Prada Group will last. Prada is content to have niche accessories brands as part of its organization, but I’m not so sure it has ambitions to add a permanent list of big players to its books. I don’t get the sense that Prada wants to follow the LVMH track – at least at this time while it readies for a generational transition and is witnessing the inherent weaknesses of Bernard Arnault’s business model in real time. The more likely scenario, in my view, is that Prada will hang on to Versace for a few years before selling it to another luxury group or a financial firm of some variety. However, if Prada begins any meaningful slump, say, after the retirement or death of Miuccia, I could imagine things going either way: a sale meant to quickly cut weight for fast cash, or as a lifeline to keep going as the company figures out its next move. We’ll know soon enough.

Fascinating as always, and this analysis deserves a second act of interpretation. To your point about Prada’s motivations, I’d argue this isn’t just about financial opportunism or brand expansion. It is a preemptive strike in an increasingly precarious luxury landscape that’s grappling with identity fatigue. Prada’s acquisition of Versace isn’t merely portfolio diversification, but semiotic diversification, at least this is how I see it. When a house like Prada, rooted in cerebral minimalism and postmodern irony, absorbs a maximalist myth-machine like Versace, the play is narrative power. Fashion, after all, is no longer just selling clothes…. it’s selling mythologies at scale.

Your observation about Miu Miu’s rise and Simons’ blunders at Prada is perfect. But here’s a twist: Miu Miu’s success isn’t just because Simons hasn’t touched it, but because it still feels emotionally authored. That’s what consumers are clinging to in the post-pandemic aesthetic drift: the illusion of auteurship. If Prada can resuscitate Versace not as a heritage label in rehab, but as a newly authored mythology with sensual intelligence and symbolic discipline, it could achieve something rare: a revival that doesn’t feel like corporate necromancy.

But only if, as you suggest, they get the quality under control. Because if Versace continues to look like a drag queen’s fever dream stitched in a polyester sweatshop, no amount of legacy will save it…..

As always so well written and honest. John Idol destroyed this brand as he did Michael’s kors. Shooting low for mass appeal. Quality isn’t even a consideration for these brands.